Before provisions for loan losses (or PPOP) are deducted, a bank's net revenue is calculated. The bank will subtract the number of negative debt provisions it estimates must be put aside to cover anticipated loan defaults from the PPOP, but this won't result in a money outflow for the institution. When cash outflows from defaulted loans are factored in, the PPOP simply estimates what will be left over for operational profit.

What's PPOP?

PPOP, or pre-provision operating profit, is the amount of money made by a bank or other financial institution before accounting for the money set aside to cover potential losses on risky debts in the future. When a bank cuts the dollar amount it believes has to be saved up in order to cover predicted mortgage defaults &'' other uncollectible debts, the PPOP is lowered. After incurring fixed monetary losses because of loan defaults, the PPOP provides a low-cost estimate of what the bank anticipates to have available for operating income.

Key Takeaways

- Pre-provision operating profit (PPOP) is the amount of money earned by a financial organization, often a bank, before deducting the amount set aside to provide for future risky debts.

- Because of the fair expectation, based on past experience, that it would lose funds on mortgage defaults and other uncollectible debts, banks often report their operating income as a PPOP to provide investors visibility into its operating revenue.

Comprehending PPOP

It's only natural that some borrowers won't pay back their debts, given that most banks have a sizable portfolio of loans outstanding to a wide variety of prospects at any one moment. Because of this, the bank may be too optimistic if it assumes that it can retain all of its operating income. Banks often report their operating income as a PPOP to provide investors visibility into their operating income despite the fact that the bank might still acquire risky debts that would reduce its bottom line.

After setting aside money to protect against potentially risky loans, the remaining PPOP amount naturally decreases. The financial institution does not see this as a loss. The amount "that" a bank takes out is dependent on the bank's past mortgage default experience. Pre-provision net income is the common phrase; although this number takes into account a wider range of expenses than just loss provisions, thus it's more accurately called pre-provision operating profit.

PPOP and Default Rates

There has been a large range in delinquency rates for individual customer loans during the last three decades. In the wake of the 2008 financial collapse and the Great Recession, this figure peaked in 2010 at close to 5%. Since then, it has steadily declined, reaching a bottom in 2015 just below two percent; as of Quarter 1 2022, it was down to 1.73%, according to the Federal Reserve Bank of St. Louis. The consumer loan industry as a whole has seen a decade of growth since the crisis. More potential customers took part, and the level of delinquency was kept below acceptable limits.

Some difficulties include the minor increase in the number of credit card and vehicle loan defaults, as well as increasing interest rates &'' political ambiguity over new regulations. The fact that banks don't seem to be willing to exclude necessary funds from their pre-provision operating income projections is, on the whole, a positive indicator for the financial services industry.

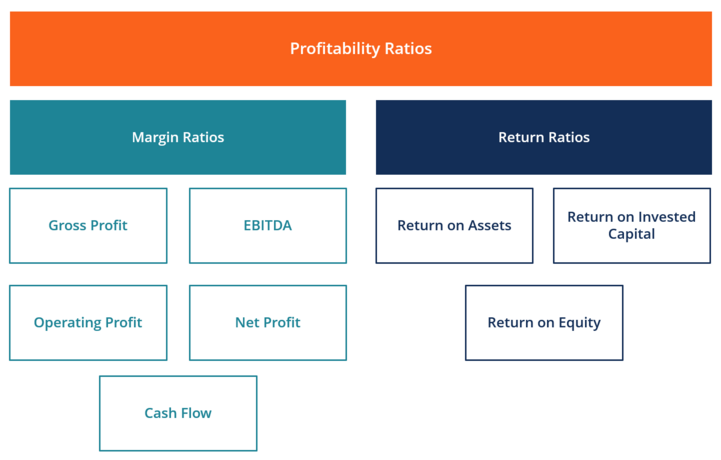

Devising New Metrics to Evaluate Profitability

Profit before provisions is one metric used to evaluate success, albeit it is mostly used in the banking sector. However, other ratios such as these may also be used to describe profitability in a company.

Gross Margin

Sales revenue is subtracted from COGS to determine gross margin (COGS). Profit is the money left over after a business pays for the materials and labor needed to make the products or supply the services it sells. A larger gross margin means that more money stays in business, which may be used toward other expenses or debt. Gross income is converted into net sales by deducting the effects of discounts, refunds, and allowances.

Operating Margin

After deducting the costs of labor and supplies, but before deducting fixed expenses like interest and tax, we get the operating margin. To get this ratio, net sales must be divided by the firm's operating income. High ratios indicate that a business is running smoothly and effectively and that it is able to convert revenues into profits.

Return on Assets

Return on assets (ROA) measures a firm's profitability relative to its total assets. ROA may be used by corporate administration, analysts, and investors to measure how well a firm utilizes its assets to make a profit for the business.

Return on Equity

Return on Equity (ROE) is a financial metric that calculates how much a firm has earned in net profits relative to the amount of equity investment that has been given by shareholders. Return on equity, which is usually represented as a percentage, is a helpful measure of a management team's competence in allocating money and creating value for shareholders.